Table of Contents

Why China Trade Shows 2026 Are Driven by Manufacturing Intelligence

Executive Summary

- China trade shows 2026 have shifted from simple product sourcing to strategic intelligence gathering, requiring buyers to look past general suppliers and instead hunt for specialized “Little Giants” and high-standard automation partners.

- Major manufacturing events like the Hainan Free Trade Port and the China High-Tech Fair now offer zero-tariff zones and “Industrial Telepathy” (digital twins), allowing strategists to validate factory capabilities and supply chain value before traveling.

- To navigate this complex ecosystem, successful sourcing now depends on acquiring a verified Canton Fair 2026 exhibitor list and accurate exhibitors data to bypass “ghost booths” and connect directly with decision-makers for high-quality trade show leads.

China Sourcing 2026: The Shift from Products to Intelligence

Look around you for a minute, see that laptop you’re reading this on, the phone sitting next to it, even the shirt you’re wearing, even when it says “Designed in California”, we all know the actual soul of that machine lives in a city in China you probably can’t even find on a map without help.

For thirty years, we have been treating an entire nation as one big vending machine, where you put in money and receive cheaper items. While we were all stuck at home during COVID, arguing about office chairs and whether or not Zoom meetings were a good idea, something happened. Sourcing from China after Covid changed fundamentally.

China did not simply stop. China upgraded. In 2026, you will not travel to China to purchase things; you travel to China to purchase intelligence. This shift in China manufacturing intelligence is exactly why most people fail to recognise the major structural change happening beneath their feet, drowned out by political noise and distractions.

Three New Industries That Are Redefining Global Supply Chains

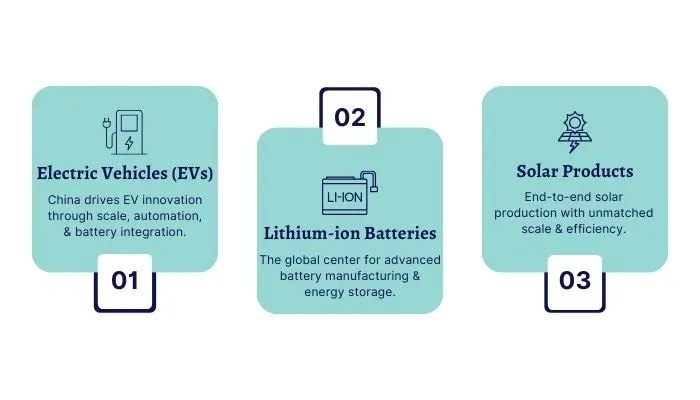

Everyone is obsessed with the headlines talking about “The West vs. The East” like it’s some 1980s movie with a predictable ending, but the reality is moving far faster than that. While the world was screaming about trade wars, the Chinese government was pouring billions into something they call “New Quality Productive Forces”, which is really just a push to lead in the “Three New” industries:

- Electric Vehicles (EVs)

- Lithium-ion Batteries

- Solar Products

Just look at the 8th CIIE in Shanghai: over 400 new products launched in a single week. Global players aren’t just selling; they are relocating R&D. Apple is expanding in Shenzhen, and Volkswagen moved its EV development to Hefei to sit directly on the battery supply chain. This ecosystem acts as a filter, weeding out non-players before they even reach the trade booth.

The High-Standard Sieve

Phrases like “High-Standard Opening-Up” sound like bureaucracy, but they are actually a sieve. While China has lifted foreign investment caps, it has drastically elevated technology standards. Only the elite enter now. As a buyer, view these restrictions as a safety net: the rigorous screening ensures that only superior manufacturers make it to the exhibition floor.

In short, the exhibition floor is now the place to find the most modern Chinese manufacturing automation. With a robot density of over 470 robots per 10,000 employees, China has surpassed Germany. This means the plant you source from here is likely more automated than facilities elsewhere. This is your opportunity to connect with the key players needed to win in the marketplace.

Hunting “Little Giants”

Here’s something you won’t see in a standard press release: the death of the “General Supplier” and the rise of the specialist. The Chinese government has funded an army of over 12,000 “Little Giants.” These aren’t massive names like Huawei or BYD, but specialised mid-sized powerhouses that own specific, high-tech niches.

Maybe they make the only sensor that can handle the heat of a base station or a specific high-precision medical component. When you walk into China trade shows 2026, these are the companies you are hunting for because they hold the intellectual property that drives the supply chain. Unless you go prepared with a list targeted at those Little Giants, you may end up wandering the floor aimlessly.

The Hainan Sandbox

If you’re still thinking about Hong Kong as the only gateway to the East, then you’re ten years behind. Have you looked at the Hainan Free Trade Port exhibitors lately? The government is turning this entire island into a zero-tariff zone, and as of 2026, it has fully transitioned into “closed-off” operation status.

For visitors and sourcing agents in Healthcare, Medical Tech, or Luxury, this is the secret back door where you can import equipment and raw materials with zero duties as long as you add value on the island. If you aren’t tracking the China exhibition market in Hainan, you’re missing the most important trade sandbox on the planet.

Industrial Telepathy

Trade shows are no longer about a booth with a few fliers; they are becoming digital twin manufacturing floors. At the China High-Tech Fair exhibitors’ area, instead of visiting a booth, you will be entering a virtual reality system that allows you to view a factory 1,000 miles away and observe its production line in real time through your headset.

The Digital Twin is much more than just a demo; it provides full transparency into China’s supply chain intelligence so buyers can inspect production lines without leaving the convention center. That is why your China sourcing strategy 2026 needs to be totally rewritten; anything less is simply a guess.

Major Trade Show Hubs in 2026

To help you navigate the “Sieve”, here are the high-stakes business expos where the China industrial policy 2026 standards are being set this year.

| Event Name | Confirmed Dates (2026) | Primary Focus Area | Why it Matters for Data Strategists |

| Canton Fair (Spring) | April 15 – May 5 | General Trade / Smart Mfg | The global benchmark; Phase 1 is critical for Automation & NEV data. |

| Hainan Expo (CICPE) | April 13 – April 18 | Luxury / Tech / Medical | The first major show after Hainan’s “Full-Island Closure” (duty-free). |

| Canton Fair (Autumn) | Oct 15 – Nov 4 | Industrial / Specialised | The peak window for identifying emerging “Little Giants” for 2027. |

| CIIE Shanghai 2026 | Nov 5 – Nov 10 | High-Tech / Import | The primary “audition” for Western-standard tech and green-tech. |

| China High-Tech Fair | Mid-November | AI / Robotics / 6G | Where Digital Twin manufacturing and smart data systems are validated. |

So what does it mean for you?

If you plan to visit the Canton Fair 2026 exhibitors, realize your role has changed. You aren’t there to collect brochures; you are there to validate intelligence. In the West, deals often start on LinkedIn; in New China, supplier verification matters most. Since real-name registration is required, verified company data is now displayed directly at the exhibit.

The old way was walking ten miles of aisles hoping to find a partner. The 2026 way is arriving with a verified China trade show exhibitors list and going straight to the decision-makers.

The Secret

Western buyers now operate inside manufacturing standards shaped by Chinese platforms. Every time a Western company sets up in Hainan, they adopt new local standards for data, green-tech, and AI. The finish line moved while we were sleeping. From the clothes you wear to your car’s software, we are already living inside a manufacturing ecosystem built in Chinese R&D labs.

So what is the actual play here?

This is a new world that is faster, cleaner, and far more discerning. Walking into a show blind is no longer just a poor decision; it is an expensive one. Before buying your ticket, you must know who is in the room. In 2026, the most valuable commodity isn’t the product, but the data identifying capable firms. Do not attend like a tourist; arrive as a strategist.

Stop wandering around. With a 2026 circuit as large as the Canton Fair or CIIE Shanghai, relying on “vibes” will not work. That is why I am providing the China trade show exhibitor database including the Canton Fair exhibitor list and CIIE Shanghai exhibitors – covering both the Little Giants and top-tier manufacturers.

Get familiarised with the room before you enter. Get your verified China trade show exhibitors list today and finalise your China supply chain strategy for western companies.

Frequently Asked Questions

- 1. Why would the “Little Giant” list be worth more to me in 2026 than a generic supplier list?

The “Little Giant” designation is the government’s stamp of approval for manufacturers who specialise in cutting-edge technology. Generic suppliers are being replaced by highly specialised partners; unless you use a verified list, you are likely dealing with a third party rather than the actual IP holder. - 2. How can I validate a manufacturing claim about automation at a 2026 trade show?

Don’t just accept what a booth rep says. With Industrial Telepathy (Digital Twins), you can use VR to watch a live feed of the factory line. However, you must first arrive with a verified list of China trade show exhibitors to confirm the manufacturer’s credentials before even putting the headset on. - 3. Will the Hainan Free Trade Port (FTP) serve as a viable sourcing hub for 2026?

Yes. Since its “closed-off” operations began, Hainan has become a tariff-free testing ground. If you source materials from Hainan FTP exhibitors, you can import goods duty-free, provided you create an additional 30% value-add on the island. It is effectively a “hidden backdoor” to the East. - 4. What makes a Verified Exhibitor List different from a generic directory?

Generic directories often contain outdated info and “ghost” booths. A verified China trade show exhibitors list for 2026 uses real-name registration and digital ecosystem data. This ensures the contact is a genuine decision-maker physically exhibiting at the event, saving procurement teams hundreds of hours.

Case Study: Exposing Fake Global Brands at World Vape Show

How a Dubai distributor used data to expose fake global brands at the World Vape Show Before World Vape Show 2026, a Dubai-based distributor was preparing to finalize two regional exclusive agreements. Dozens of...